New Value

Added value through the economic use of brands, patents & know-how

Innovative companies own patents, brands, and know-how – but the value of this intellectual property is often underestimated. Our PATEV experts valuate intangible assets and help to use these values as a tradable resource, for example as a financing instrument or as part of corporate transactions.

Intellectual property as a strategic asset: We show you how!

Expert Opinion

Did you know that patents and other intangible assets account for 30 to 70 % of the company value? We determine the value of trademarks, patents, and know-how according to national and international standards and prepare an independent expert opinion, always in close consultation with legal and tax advisors. This allows our clients to make invisible capital visible and use it in a wide variety of scenarios.

TYPICAL QUESTIONS

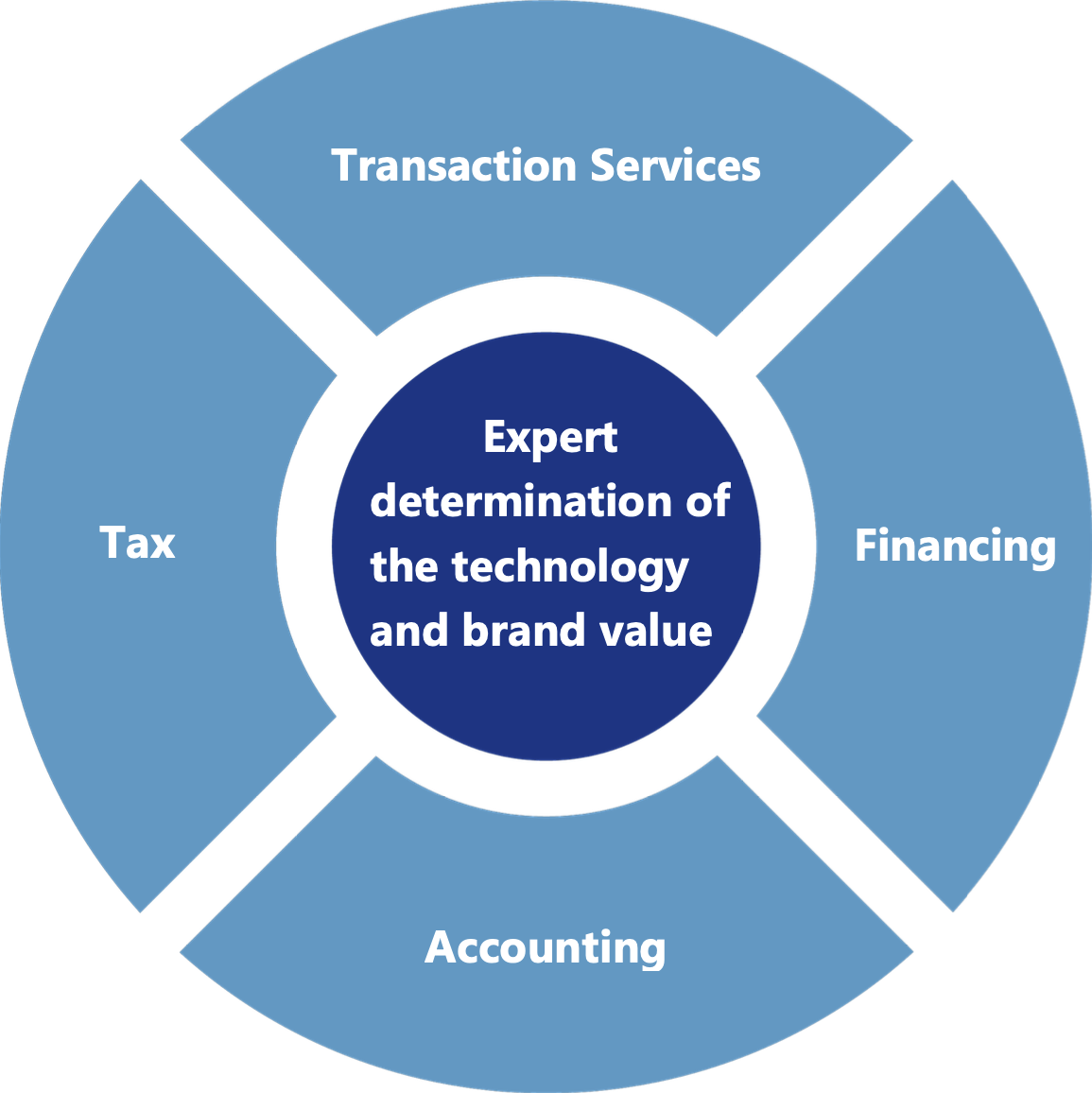

Transaction services

What is the "fair value" of IP for licensing, acquisitions & sales, and equity investments / M&A?

1. What is the valuable IP (especially patents & know-how) and what is its (economic) "fair value"?

2. What is the robust value of the IP (neutral valuation report as a basis for negotiations)?

3.How is the technology positioned in global competition and can a technological claim of leadership be confirmed?

Financing

How can IP-based financing be built and additional room for action be uncovered?

1. Do banks reach their limits when it comes to the relevant financing requirements (e.g. entering new markets, plant investment, restructuring) and are alternative financing instruments needed?

2. Are you looking for new, alternative approaches to find an appropriate financing solution?

3. How can existing IP be made visible and usable as an asset for debt financing?

Accounting

How can the IP value be used as a possibility to shape the balance sheet?

1. What is the (economic) value of the IP as an asset, in the sense of a neutral and transparent expert opinion?

2. How is IP to be valued in order to use it as a possibility to shape the balance sheet?

Tax

How can the license rate for IP Transfer Pricing be determined on a case-by-case basis so that all parties involved are compliant, thereby ensuring economic security?

1. How is relevant IP to be valuated in international trade (especially in international transfer pricing)?

2. How can the basic license rate be adapted to the specific situation through technological case-by-case assessment?

3. How can technology trends be identified or characterized to make the opportunities and risks in connection with the underlying IP tangible?

Why PATEV?

Certified quality, taking (inter)national standards into account

> 20 years of experience in expert opinions

Large network of renowned partners

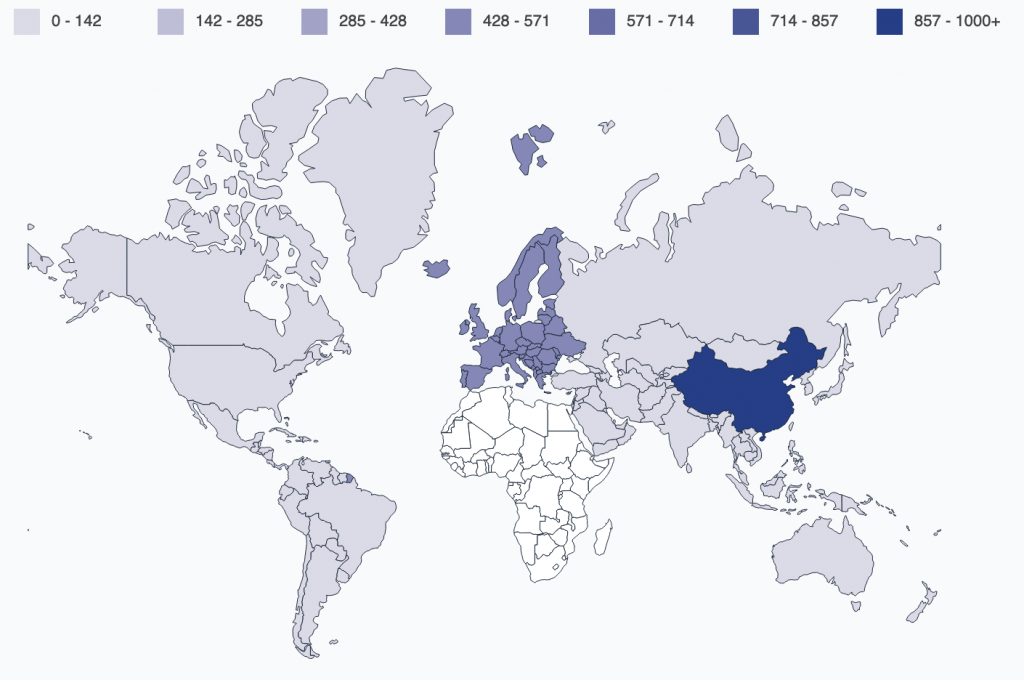

Resilient, global benchmark through Innovation Intelligence

From New Value to New Business

We go one step further: With the help of Innovation Intelligence, we develop systematic new business strategies if required. Whether “Best Partner” or “Best Owner”, we find the best technological match!

What is the worth of your intellectual property?

We will be happy to explain the potential of brand and technology valuation and develop profitable strategies for your company.

Further information

“PATENTS AND BRANDS AS VALUABLE SOLUTION COMPONENTS” ARTICLE BY PATEV AND PWC IN “Deutscher AnwaltSpiegel”

We are happy to announce the publication of our article (available in German only): “Patente und Marken als werthaltige Lösungsbausteine” (“Patents and trademarks as valuable solution modules”) in the online magazine “Deutscher AnwaltSpiegel” by Andreas Sticher (Business Recovery & Transformation, PwC) and Christina Koller (Director Technology & Brand Valuation, PATEV).

PATEV M&A Search

Are you working on M&A activities and are looking for ways to complement your target list?

Why not use 80% of global technology knowledge to identify suitable target companies (“best match”) for your M&A activities based on their competencies?

MuMAC 2022: Cross-Border M&A and Private Equity Conference

Game-Changer Geostrategy: The Transactional Ripple …

Under “Resources” you will find all of our publications around Innovation Intelligence to download.