New Value

Wertschöpfung durch die wirtschaftliche Nutzung von Marken, Patenten & Know-how

Innovative Unternehmen besitzen Patente, Marken und Know-how – aber wie wertvoll dieses geistige Eigentum ist, wird häufig unterschätzt. Unsere PATEV Experten bewerten immaterielle Wirtschaftsgüter und helfen, diese Werte als handelbare Ressource einzusetzen, beispielsweise als Finanzierungsinstrument oder im Rahmen von Unternehmenstransaktionen.

Intellectual Property als strategisches Asset: Wir zeigen Ihnen, wie!

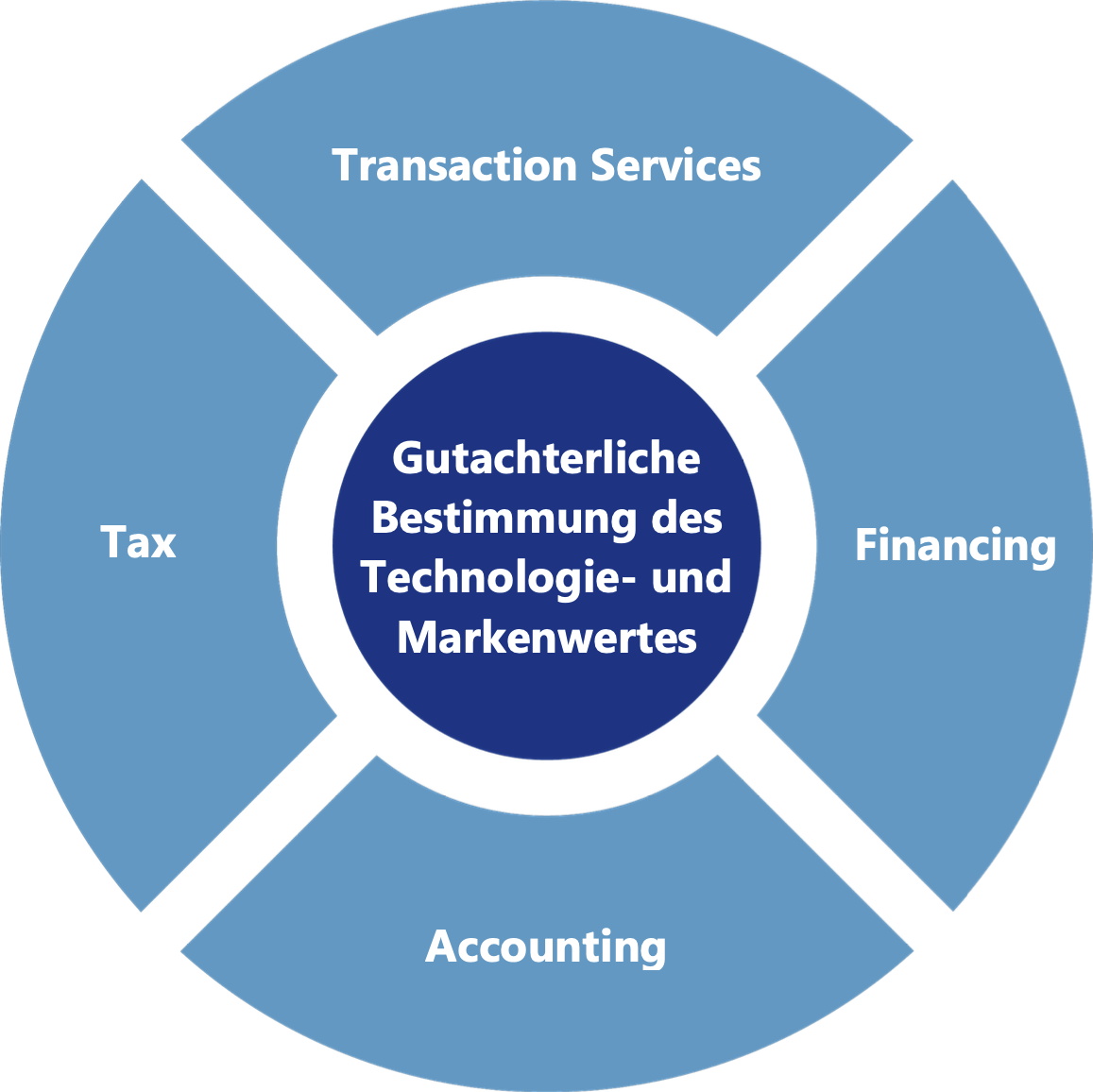

Das Gutachten

Wussten Sie, dass Patente und andere immaterielle Wirtschaftsgüter 30 bis 70 % des

Firmenwertes ausmachen? Wir ermitteln den Wert von Marken, Patenten und Know-how nach nationalen und internationalen Standards und erstellen ein unabhängiges Gutachten, immer in enger Abstimmung mit rechtlichen und steuerlichen Beratern. Damit unsere Kunden unsichtbares Kapital sichtbar machen und in verschiedensten Szenarien einsetzen können.

Typische Fragestellungen

Transaction Services

Was ist der „Fair Value“ der IP für Lizenzierungen, Käufe & Verkäufe sowie bei Beteiligungen / M&A?

1. Was ist das werthaltige IP (insbesondere in Form von Patenten & Know-how) und wie ist dessen (ökonomischer) „fair value“?

2. Was ist der robuste Wert des IP (neutrales Wertgutachten als Verhandlungsgrundlage)?

3. Wie ist die Technologie im weltweiten Wettbewerb positioniert und lässt sich ein technologischer Führungsanspruch bestätigen?

Financing

Wie kann eine IP-basierte Finanzierung aufgebaut und zusätzliche Handlungsspielräume aufgetan werden?

1. Kommen Banken bei dem Finanzierungsbedarf (z.B. Erschließung neuer

Märkte, Anlageninvestition, Restrukturierung) an ihre Grenzen und es

braucht alternative Finanzierungsinstrumente?

2. Suchen Sie neue / alternative Handlungsfelder / Ansätze zur Gestaltung einer Finanzierung?

3. Wie kann das bestehende IP sichtbar und als werthaltiges Asset zur Fremdkapitalfinanzierung nutzbar gemacht werden?

Accounting

Wie kann der IP-Wert als Gestaltungsinstrument in der

Bilanz genutzt werden?

1. Was ist der (ökonomische) Wert des IP als Asset, im Sinne eines neutralen und transparenten Gutachtens?

2. Wie ist das IP zu bewerten, um dieses als Gestaltungsmöglichkeit in der Bilanz nutzen zu können?

Tax

Wie kann eine einzelfallspezifische Ermittlung des Lizenzsatzes bei IP Transfer Pricing erfolgen, damit alle Beteiligten konform gehen und dadurch wirtschaftliche Sicherheit gewährleistet wird?

1. Wie ist das relevante IP internationalen Warenverkehr (insbesondere im International Transfer Pricing) zu bewerten?2. Wie kann der Basislizenzsatz im Sinne einer technologischen Einzelfallprüfung auf die konkrete Situation angepasst werden.

3. Wie können Technologietrends erkannt bzw. charakterisiert werden, um die Chancen und Risiken in Verbindung mit dem zugrundeliegenden IP greifbar zu machen.

Warum PATEV?

Zertifizierte Qualität nach (inter)nationalen Standards

> 20 Jahre Gutachter-Erfahrung

Großes Netzwerk renommierter Partner

Belastbarer, globaler Benchmark durch Innovation Intelligence

Von New Value zu New Business

Wir gehen noch einen Schritt weiter: Mit Hilfe von Innovation Intelligence entwickeln wir bei Bedarf systematische New-Business-Strategien. Egal ob „Best Partner“ oder „Best Owner“, wir finden den besten technologischen Match!

Und was ist Ihr geistiges Eigentum wert?

Fragen Sie uns, wir erläutern Ihnen das Potenzial der Marken- und Technologiebewertung und erarbeiten individuelle Lösungen mit Ihnen.

Lese-Tipps

PwC und PATEV – Ein starkes Team: Im zweiten WebCast dreht sich alles um „Predictive Restructuring“

Unter dem Titel „Innovationen und Patente – Entscheidend im Transformationsprozess (Predictive Restructuring)“ behandeln wir diesmal die Rolle von technologischem Wissen, Innovationsleistung und Patenten für Unternehmen, um Krisen zu bewältigen und den Wandel erfolgreich zu gestalten. Dabei wird der Transformationsansatz „Predictive Restructuring“ erläutert und durch Praxisbeispiele veranschaulicht.

PwC und PATEV – Ein starkes Team: Start der gemeinsamen WebCast-Reihe

Anlässlich des gemeinsamen Angebots im PwC-Store starten PwC und PATEV in eine spannende neue WebCast-Reihe. Im Mittelpunkt steht dabei die Nutzung und Anwendung von Informationen über Unternehmen und Technologien in unterschiedlichen Szenarien (z.B. R&D, M&A oder Supplier-Scouting).

„Patente und Marken als werthaltige Lösungsbausteine“ Artikel von PATEV und PwC im Deutschen AnwaltSpiegel

Wir freuen uns über die Veröffentlichung unseres Artikels: „Patente und Marken als werthaltige Lösungsbausteine“ im Online-Magazin „Deutscher AnwaltSpiegel“ von Andreas Sticher (Business Recovery & Transformation, PwC) und Christina Koller (Director Technology & Brand Valuation, PATEV).

Unter „Ressourcen“ finden Sie alle unsere Publikationen rund um Technologie- und Markenbewertung zum Download.